http:/https://oilandenergyinvestor.com/wp-content/themes/inove_oei/img/logo.png

by Dr. Kent Moors

A solar energy project is completed every two and a half minutes in America.

In China, that pace is even faster.

So it’s no wonder that world’s solar-generation capacity has grown 100-fold over the last 15 years, and is now the equivalent of about 178 nuclear plants.

And that’s just the beginning…

The average price of a solar panel has declined by more than 85% since 2009, and technological advances are pushing costs even lower. That means that today, solar is as cheap – or cheaper – than other sources of power in areas like Los Angeles, San Francisco, and even Boston. More than 30 million Americans now live in areas where that’s true… a number set to grow to 71 million by the end of 2017.

Companies have seen the writing on the wall, and are moving to build their own solar power generation and save money in the long run. Target Corp. (TGT), Wal-Mart Stores Inc. (WMT), Apple Inc. (AAPL), IKEA – all have 44 to almost 150 MW of solar power deployed each, all across the country.

Even the U.S. Department of Defense is moving into solar, with plans to convert more than 40 military bases to be energy self-sufficient, so that they can continue to operate in case of an attack on the power grid.

Solar power is the main electricity source for this project, and so far several bases have had solar power plants constructed, including a 500-megawatt facility in the Fort Irwin Army Base in the Mojave Desert, the Pentagon’s largest, and a 14-megawatt facility at the Nellis Air Force Base in Nevada (pictured here).

The Department of Defense and SolarCity Corp. (SCTY) are also planning to provide solar power to 120,000 military housing units, which would be the largest residential solar cell project in the U.S.

Now, while solar power is growing rapidly in the U.S., it is positively booming in Asia…

Solar is Growing Even Faster in Asia

China alone installed 34 gigawatts of solar panels in 2016, the equivalent of 34 nuclear reactors. That number is up 126% from the year before.

Meanwhile, Japan is pushing for more solar to make up for the nuclear power it shut down following the 2011 Fukushima nuclear disaster. The country already has the third-largest solar panel capacity in the world, at 23 gigawatts, a number it plans to almost triple in only 15 years.

Perhaps most importantly, India is planning to use solar power to replace its infamously bad electrical grid, which suffers from frequent brownouts, high electricity prices, and leaves large parts of the country without access to any electricity at all. India’s 300 days of sunlight per year on average make this transition more than possible. And for communities that are used to no power or frequent brownouts, the fact that solar only works during the day is not an issue.

The Indian government is making a massive push for more solar power, aiming for 100 gigawatts of solar capacity by 2022, up from about 4 gigawatts today. An investment of $100 billion is being targeted toward that goal, and a number of incentives have been made available for developers to speed up the adoption of solar power technology in India.

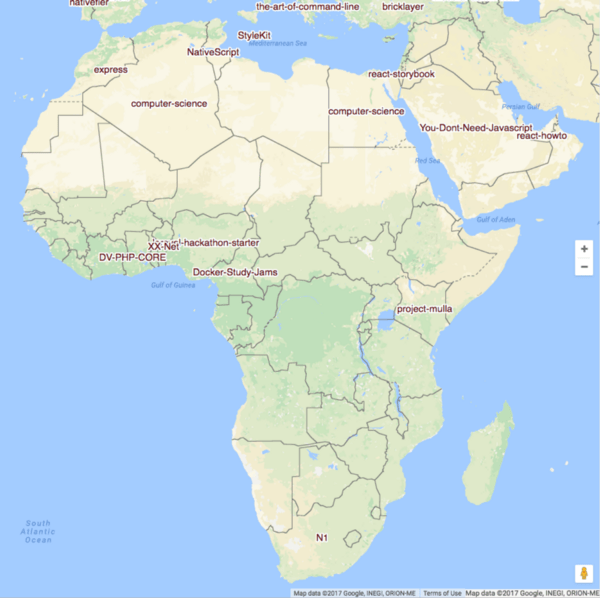

As you can see, the biggest growth in solar power in the near future will be in Asian countries. But the solar market is huge, with hundreds of companies, large and small, fighting for a share of this global boom market.

While it may be difficult to pick out the winners at this early stage, there is a much simpler, less risky way of tapping into the global solar boom: solar power exchange-traded funds (ETFs). And as the fastest growth in solar power is happening in Asia, investors should focus on funds with significant holdings in China, India, and beyond.

That’s why I’ve assembled this list of the two best ETFs with holdings in the solar power industry all over the world.

The Two Best Solar Power ETFs

With the price for the average solar panel having declined by more than 60% since 2011, solar power is quickly replacing coal as the most economical source of electricity. But wind power is also rapidly getting cheaper, with the cost of wind in the U.S. having fallen by more than 90% since the 1980s. And wind and solar can often complement each other, especially in Asian countries where monsoon season sees less sunlight, but more wind.

For investors looking to tap into the growth opportunities presented by both renewable power sources, the iShares Global Clean Energy ETF (ICLN) invests in renewable power companies and utilities, as well as their suppliers and the whole renewables supply chain, all over the world. With holdings in solar, wind, and other renewables, and with about 25% of investments in the U.S. and another 25% in China, this ETF is well poised to rise as renewable energy continues to develop globally.

iShares Global Clean Energy ETFTicker: (ICLN)

Recent Price: $8.51

52-Week Range: $7.73 – $9.68

Yield: 3.54%

*As of 3/21/2017

The barrier to adopting renewables, their fluctuating power generation, has been removed by upgrades to the electrical grid. But these upgrades will have to continue, and as countries like China and India continue to expand their electrical grids and renewable power generation, the demand for grid upgrades will grow even more.

These upgrades include technologies such as smarter sensors to enable load balancing, energy storage to bridge the gap between when renewables create power and when we consume it, and higher capacity transmission networks to carry the electricity produced by renewables, often in remote locations, to where it is needed. In 2013 alone, China spent $4.3 billion on smart meters. That’s just a drop in the bucket for a country with 1.35 billion people, even if you don’t account for the need to replace those smart meters with newer, more advanced ones.

This energy infrastructure spending makes the First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID) a good bet. This ETF aims to track the performance of stocks in the global power infrastructure sector by investing in companies involved in electric grid, meters, networks, energy storage and management, and grid software.

These plays are enough to get anyone started on taking full advantage of the profit potential of the energy sector, but we’re only scratching the surface.

This fuel is so cheap, so easy to access, and so abundant that Fortune 500 companies – including Google, Apple, and Facebook – are investing billions to move into this technology.

At the same time, nearly every major energy player on the planet is shunning oil in favor of this new fuel.

And make no mistake: This “universal fuel” will enable America to declare complete energy independence for the first time in 40 years.

[visit link to article in full & check for FULL ANALYSIS LINK ACCESS]: below