By Alex McGuire, , •

When you purchase shares of the best dividend stocks to buy now, you get two things – profits as share prices rise and regular cash payments.

As you know, companies with dividend policies pay you money every single quarter just for holding their stock. But the best dividend stocks (like the ones we’re about to show you in this report) also dramatically outperform the broader market.

Take, for example, one of the most popular dividend stocks of the last several decades: McDonald’s Corp. (NYSE: MCD).

Shares of MCD are known for being unaffected by broader market volatility. During the financial crisis from Aug. 10, 2007, to March 6, 2009, the Dow Jones plunged 46.8%. On the other hand, MCD stock actually gained 7.4% over the same period.

During that time, McDonald’s was also able to raise its dividend. The firm increased it from $0.38 to $0.50 by November 2008. That generous dividend hike was four months before the stock market’s bottom on March 6, 2009.

But dividend investing isn’t as simple as picking any high-yield, high-growth stock. And just because a stock like MCD may be the “popular” pick, that doesn’t mean it’s the best.

Our Money Morning investing gurus select dividend stocks not only because they offer high yields and share-price potential, but also because they have a presence in a strong, profitable market.

Here are seven of the best dividend stocks to buy for 2018…

Best Dividend Stocks to Buy No. 5: Apple Inc.

Yes, its 43.6% return in 2017 has made it one of the most profitable tech stocks of the year. But Apple Inc. (Nasdaq: AAPL) also boasts one of the strongest dividends in the market despite problems with its dividend policy in the past.

You see, Apple paid steady dividends from 1988 to 1995. Over that time period, the quarterly payout increased 20% from $0.10 per share to $0.12.

However, the company started mounting huge losses mainly due to the sales failure of the Newton, a line of personal digital assistants that sucked $100 million out of Apple during the mid-1990s. When co-founder Steve Jobs returned to the company in 1997, the dividend policy was nixed so Apple could start growing its cash reserves.

By August 2012, Apple’s cash reserves had reached around $100 billion. That was when the firm decided to reinstate its dividend at $0.38 per quarter – more than triple its last $0.12 quarterly payout 17 years prior. The quarterly AAPL dividend currently sits at $0.63 per share.

With that, Apple is one of the only leading tech companies to pay a dividend. Other giants like Alphabet Inc. (Nasdaq: GOOGL), Amazon.com Inc. (Nasdaq: AMZN), and Facebook Inc. (Nasdaq: FB) don’t have dividend policies.

That’s one reason why Money Morning Capital Wave Strategist Shah Gilani considers Apple stock one of the best value stocks to buy today. And it’s proved its status as a growth stock this year with gains of 43.6% in 2017, from $115.82 to $166.32.

“Apple Inc. keeps defying gravity,” Shah told Money Morning readers. “Its most recent earnings story was just extraordinary. Records are just being blown away left and right. And, believe it or not (and you’d better believe it), the stock is still cheap.”

Apple’s share appreciation and generous dividend compared to other tech titans make it more than worth your money this year.

Company: Apple Inc.

Share Price: $166.32

Quarterly Dividend Payment: $0.63

Dividend Yield: 1.51%

Date of First Dividend Payment: Nov. 21, 1988; discontinued 1997; restarted 2012Best Dividend Stocks to Buy No. 4: Scotts Miracle-Gro Co.

Founded in 1868, Scotts Miracle-Gro Co. (NYSE: SMG) manufactures and sells a wide variety of garden products. The uses for its line of products have traditionally included insect control, lawn fertilization, gardening, and landscaping.

While it’s long been a leader in the gardening and lawn-care market, Scotts Miracle-Gro has recently been pushing into the marijuana sector. This is one of the biggest reasons why Money Morning Director of Tech & Venture Capital Research Michael A. Robinson likes SMG stock.

“Scotts is already the world’s largest maker of lawn-care and gardening products, and is now making a big push into indoor plant cultivation, as evidenced by its April 2015 $150 million purchase of General Hydroponics and other pot-related acquisitions,” Robinson said.

Special Report:Cannabis Is the Gold Rush of the 21st Century – 30 Stocks to Invest in Now. Details Here…

The explosive growth of the marijuana market will be a huge catalyst for the SMG stock price. According to New Frontier Data’s 2017 Cannabis Industry Annual Report, medical marijuana sales are expected to soar from $4.7 billion last year to $13.3 billion by 2020. The cannabis industry is also expected to create more than 250,000 jobs in the next three years – more than utilities, manufacturing, or even government jobs.

A recent Yahoo Finance survey of analysts shows shares of Scotts Miracle-Gro could rise to $107 in the next 12 months. That would be a return of 7.2% from the today’s price of $99.81.

While that may not be a huge profit, SMG stock more than makes up for it with a yield of 2.12% and quarterly dividend of $0.53 per share. The firm’s dividend has increased every year since 2013, rising 20.5% from $0.44 to $0.53.

The SMG dividend is also bigger than those offered by close peers Central Garden & Pet Co. (Nasdaq: CENT) and Andersons Inc. (Nasdaq: ANDE). Central Garden doesn’t offer a dividend, while Andersons only pays $0.16 per share for a 1.72% yield.

Company: Scotts Miracle-Gro Co.

Share Price: $99.81

Quarterly Dividend Payment: $0.53

Dividend Yield: 2.12%

Date of First Dividend Payment: Aug. 16, 2005

Best Dividend Stocks to Buy No. 3: Lockheed Martin Corp.

With shares currently at an all-time high and expected to go higher, Lockheed Martin Corp. (NYSE: LMT) is one of the best defense stocks to own that also happens to have a strong dividend.

LMT stock is up 23.2% in 2017, with much of its gains coming on the back of high-profile weapons contracts…

In May 2017, President Trump made a deal with Saudi Arabia for the country to purchase more than $28 billion worth of missiles, Black Hawk helicopters, and other defense weapons from Lockheed. The Saudi government agreed to spend $110 billion overall on defense contracts, which also lifted shares of peers Raytheon Co. (NYSE: RTN) and Boeing Co. (NYSE: BA).

Lockheed Martin stock is also up 28.1% since May 2016 thanks mostly to Trump’s promise to increase military spending by $54 billion. That – combined with clearly strong international demand for the company’s products – could send the LMT stock price soaring in 2018.

Analysts say the stock could rise to $363 per share in the next 12 months. This would represent a 17.9% return for investors if they buy in at today’s price of $307.83.

On top of those solid gains, Lockheed offers shareholders a quarterly dividend of $2, good for a 2.6% yield. That beats out the General Dynamics Corp. (NYSE: GD) dividend of $0.84 (1.66% yield) and United Technologies Corp. (NYSE: UTX) dividend of $0.70 (2.33% yield).

With growing demand for defense weapons overseas and a big dividend as well, LMT is a great investment for both growth and value investors.

Best Dividend Stocks to Buy No. 2: Sanofi SA

Another one of the best dividend stocks to buy for 2018 is France’s largest pharmaceutical company – Sanofi SA (NYSE ADR: SNY).

This pharma giant – which is also the fifth-largest drugmaker in the world – produces some of the most recognizable and consumed medications on the market. These brands include leukemia treatment Lemtrada and sleeping medication Ambien.

Michael Robinson likes Sanofi due to its huge pipeline of blockbuster drugs coming to market. Of the 47 total medications and vaccine candidates in the pipeline, 13 of them are either in phase 3 trials or have been submitted to the FDA for approval. According to Michael, about half of those drugs in phase 3 have come from partnerships with other companies.

Sanofi’s collaboration with other firms is a good way to save cash that could later be used to hike its dividend or fund other projects.

“This is something we’re seeing more and more of in pharma these days,” Michael told Money Morning readers. “In my view, it’s a smart move to help split up the costs and risks of new drug development.”

But the even bigger catalyst for SNY stock will be the company’s expansion into the Chinese market.

China already makes up one-third of Sanofi’s revenue and is the firm’s third-largest buyer behind the United States and France. With plans to release more than 10 new drugs in China by 2020, Sanofi is perfectly poised for long-term growth just in that market alone.

“Given the relative immaturity of China’s biotech and generic drugmakers, it will be years until they stop looking to the West for help managing their pharmaceutical demands,” Michael said. “Those years of baked-in growth suit Sanofi just fine.”

Analysts see SNY stock rising to $57 in the next year. That would be a solid 21.8% return from today’s price of $46.78.

Sanofi also provides a dividend of $1.64 per share and has a 3.5% dividend yield. For comparison, the SNY dividend beats out Merck & Co. Inc.’s (NYSE: MRK) $0.47 dividend (3.38% yield) and Johnson & Johnson’s (NYSE: JNJ) $0.84 dividend (2.4%).

Company: Sanofi SA

Share Price: $46.78

Quarterly Dividend Payment: $1.64

Dividend Yield: 3.5%

Date of First Dividend Payment: May 28, 2003

Best Dividend Stocks to Buy No. 1: PIMCO Strategic Income Fund Inc.

You may not recognize its name, but PIMCO Strategic Income Fund Inc. (NYSE: RCS) is the best way to earn passive income from both U.S. and foreign-issued bonds. It’s so effective that Keith calls it a “money machine.”

“I’ve called RCS my favorite ‘money machine’ in the past because of its ability to deliver double-digit yields to investors on a monthly – not quarterly – basis,” Keith explained. “Reinvested, those monthly payouts compound a lot faster than quarterly ones, especially with a starting yield that’s as high as RCS offers.”

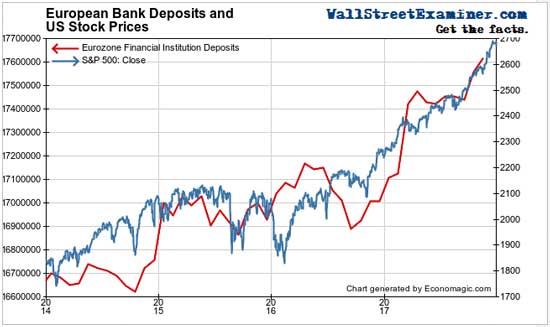

PIMCO Strategic Income Fund offers exposure to debt investments like corporate bonds and mortgage-backed securities (MBSs). Both of these instruments have posted positive returns this year and let investors earn passive, steady income. The S&P U.S. High Yield Corporate Bond Index and Vanguard Mortgage-Backed Securities Index Fund – which are proxies for their respective investments – have gained 7% and 1% in 2017, respectively.

While the RCS stock price is only up 3.4% in 2017, it trades at a discount compared to similar income funds. RCS trades at $9.09 per share right now. Its price is much cheaper than other PIMCO income funds like the Dynamic Credit and Mortgage Income Fund (NYSE: PCI) and Global Stocks Income Fund (NYSE: PGP). Those cost $22.67 and $16.21 per share, respectively.

RCS pays shareholders a monthly dividend of $0.07. While that may not be a stunning dividend, it represents a massive yield of 9.49%. That means the firm is giving most of its profit back to shareholders – a strong indication of a reliable company that puts investors first.

High-yield dividend stocks like RCS are a great way to earn passive income each month. But Keith has been researching even more aggressive income potential, too.

He’s found a special class of investments he calls “26(f) programs,” which give investors the opportunity to tap into huge monthly income – $2,000… $5,000… or more – every month for the rest of their lives.

Click here to learn how it works…

full link article visit here @

https://moneymorning.com/active-premiums/the-7-best-dividend-stocks-to-buy-in-2017/?moneymorning_subscribe=complete&email=djmims14%40yahoo.com